Portfolio Value For A $100K Portfolio Earning 5% Annually Fund

#Gross expense ratio how to#

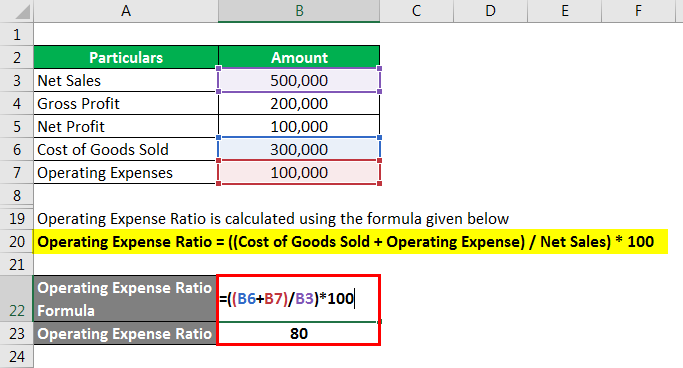

If you are curious to learn more about what to invest in aka asset allocation, read here: How to Master Asset AllocationĪfter 30 years at 5% annual returns, your portfolio in FZROX would be worth $5,034 more than VTSAX, $11,247 more than SPY, and $134,047 more than in FWDI. The only difference between the portfolios is the expense ratios charged by the fund, since each portfolio is invested entirely in 1 fund. With no additional contributions, here’s how the portfolio’s value would grow, assuming a 5% annual return. We took the portfolio value after 1 year, 10 years, 20 years, and 30 years (when you’d be 65 years old). For this example we assumed you are 35 years old. How Do Expense Ratios Affect The Value Of My Portfolio?įor this exercise, let’s again assume you are beginning with a portfolio of $100,000. Let’s take a look and see how the total value of the portfolio would be affected by these expenses. And 31.5X higher than VTSAX’s 0.04% expense ratio!Īfter 10 years, the total fees you’d pay would range from $0 all the way to $15,298. FWDI has an expense ratio of 1.26%, which at first glance might not seem too high, but it is! Remember that expense ratios are one of the most important factors when it comes to choosing investments, since they eat up your returns! It’s 14X higher than the next highest expense ratio of the funds we compared. Over 1 year and 10 years, $100,000 at an annual 5% return, the expense ratios would result in the following fees: TickerĪfter 1 year of investing $100,000, you’d pay less than $100 in fees on all of the funds with the exception of FWDI. To make the comparison I chose a few different index funds and exchange traded funds (ETFs): Ticker If you portfolio is larger or smaller, you can just scale these numbers to fit your needs. To see what the math looks like, let’s begin by assuming you have a portfolio of $100,000. How Much Will You Save By Cutting Expenses To Zero These funds are starting to sound like a no-brainer for many investors, but first let’s look at the numbers. When there’s competition, the consumer wins! It’s currently a very competitive market and all of the brokerages are fighting to acquire new customers. Both of Fidelity’s new zero cost funds have expense ratios of 0.0%, have no marketing fees, and if bought directly from Fidelity have no transaction fees. Yes! This isn’t a gimmick or a limited time offer. To answer the questions about whether it makes sense to switch to Fidelity to access these no-fee funds, let’s dig into the numbers to see how much money you’d save, and also take into account other reasons (potential tax implications, convenience, etc.) why it may make sense or not make sense to switch over.īut first, do these new funds truly have no hidden costs? Do These New Fidelity Funds Actually Have No Costs?

:max_bytes(150000):strip_icc()/AppleOperatingRatioExample-5c731357c9e77c000107b603.jpg)

If you’ve read our intro to asset allocation, then you already know that these funds will be popular for those saving for retirement due to the broad diversification that they offer. With the frenzy around these new funds, we’ve been getting bombarded on Instagram (we LOVE hearing from our readers so keep the questions coming) about whether it makes sense to switch from Vanguard, Charles Schwab or other brokerages to Fidelity to take advantage of these new index funds with zero expenses. This means that every penny you invest will be working for you instead of some of your money going to line the pockets of the mega-rich brokerages that hold your investments. Which is exactly what they are calling their new funds: Fidelity ZERO Total Market Index Fund and Fidelity ZERO International Fund. Fidelity, one of our favorite investment managers, recently announced that they’d begin offering two separate index funds with no commission fees and expense ratios of zero.

0 kommentar(er)

0 kommentar(er)